Fuel Switch Snapshot: Going from gas to oil

Gas-to-oil switching in Rotterdam

All bunker fuel prices sharply down

B24-VLSFO at rare parity with B24-LSMGO in Singapore

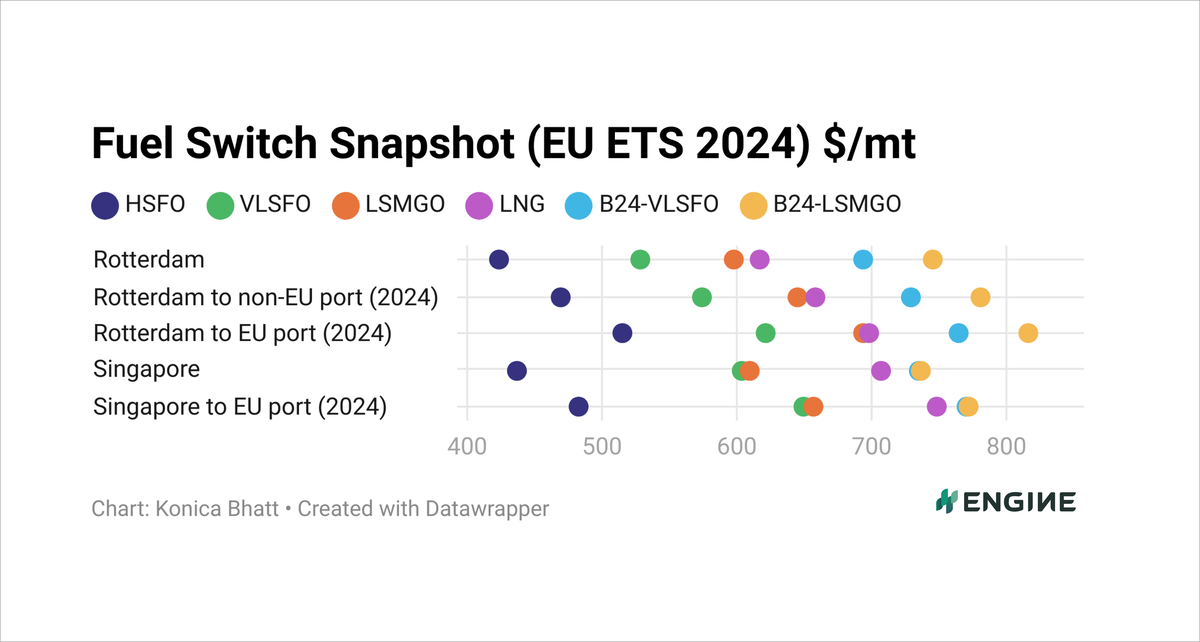

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

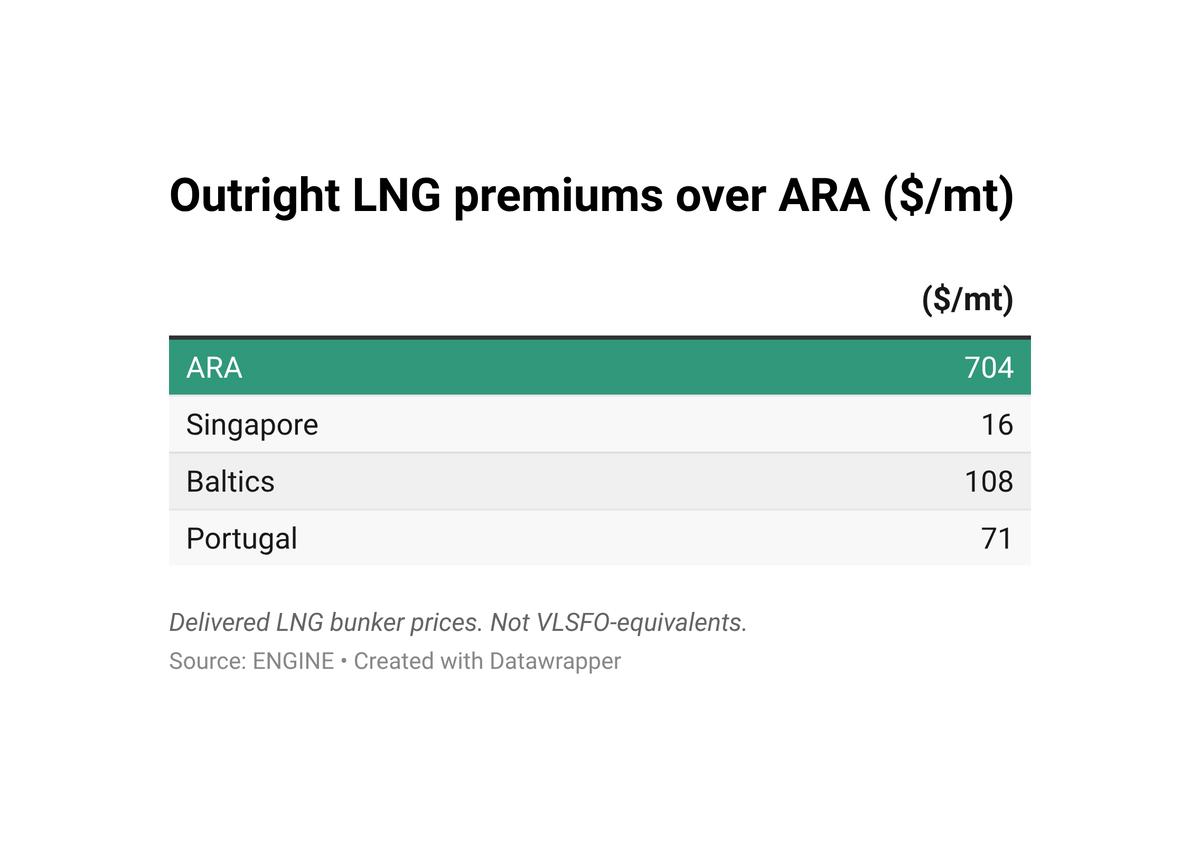

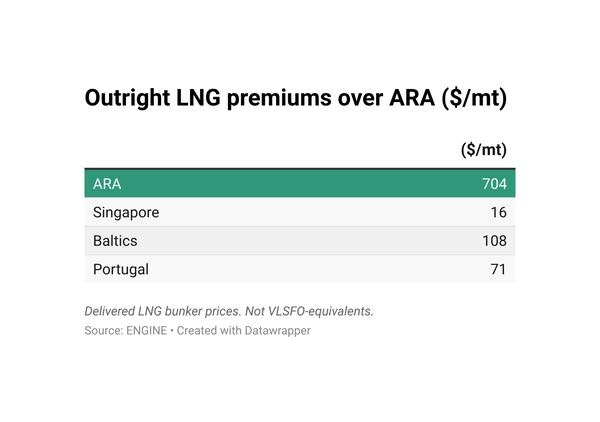

Dual-fuel vessel owners are increasingly switching from LNG to oil, some LNG suppliers told ENGINE. One supplier noted a shift away from smaller LNG stems, which carry higher delivery premiums per mt than larger ones. VLSFO and LSMGO prices are now more attractive than LNG in Rotterdam, even with estimated EU Allowance (EUA) costs added.

HSFO has been the cheapest fuel option in Rotterdam since 7 May. VLSFO became cheaper than LNG on 27 May. LSMGO recently dipped below LNG, too, and a supplier says that gas-to-oil switching has picked up. All of these prices are VLSFO-equivalents and therefore comparable with one another.

Rotterdam’s LNG price is $194/mt higher than that of HSFO, $89/mt higher than VLSFO and $19/mt higher than LSMGO.

In addition, vessels operating in European Emission Control Areas (ECAs) typically choose between LNG and LSMGO, so a more attractive LSMGO price can significantly influence their fuel choice.

VLSFO

Front-month Brent futures have plummeted $5.87/bbl ($43/mt) lower over the past week, marking its biggest weekly drop in 11 months.

This dramatic collapse has triggered sharp $23-44/mt drops in Rotterdam’s conventional bunker fuel prices. The prices fall by steeper $28-39/mt when factoring in estimated EUA costs for voyages between two EU ports.

VLSFO availability remains stable in ARA, with suppliers able to offer prompt delivery dates.

Singapore’s conventional bunker prices have slumped $30-50/mt lower in the past week. VLSFO fell by $30/mt amid tight supply, and could otherwise have fallen more.

VLSFO availability in Singapore remains constrained as some suppliers face low stock levels and terminal loading delays. The tight supply situation is expected to persist through the first half of September, according to a source.

Biofuels

Singapore's B24-LSMGO has plunged $41/mt lower and to rare parity levels with B24-VLSFO, which made a smaller $24/mt price drop.

This is highly unusual, and made possible by tight VLSFO supply and a 4% higher energy content in LSMGO. Both prices are VLSFO-equivalents.

B24-LSMGO should be more valuable than B24-VLSFO as it can be consumed in ECAs without scrubbers.

Rotterdam's B24-LSMGO HBE price has also fallen by more ($31/mt) than B24-VLSFO HBE ($20/mt) in the past week.

Decreases in Rotterdam's pure VLSFO (-$23/mt) and pure LSMGO (-$36/mt) prices have contributed to the declines for both biofuel blend benchmarks. So has a $9/mt drop in the POMEME CIF ARA price, to $1,336/mt, according to PRIMA Markets.

LNG

LNG bunker prices in both Rotterdam and Singapore have also tumbled in the past week. The drops have come amid weaker demand in the wider gas market, as well as high gas storage levels in Europe and reduced power consumption in Asia.

Rotterdam’s LNG bunker price has plunged by $42/mt over the past week, tracking a sharp downward movement in the front-month NYMEX Dutch TTF Natural Gas contract.

The price drop is primarily due to weaker demand, influenced by concerns about global economic growth and improved gas supply conditions in Europe. Mild weather and stable LNG shipments are also contributing to lower prices, according to Energi Danmark.

Singapore’s LNG bunker price has made a more modest decline of $13/mt in the past week, driven by a lower NYMEX Japan/Korea Marker (JKM) benchmark.

The price reduction in Singapore is tied to decreased LNG demand in Japan. Recent outages at key Japanese gas-fired power plants, caused by fuel shortages and equipment issues, have further reduced LNG consumption, Rystad Energy said.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online