Crude futures set for +10% weekly gains on OPEC+ cut

Front-month ICE Brent has increased by $1.55/bbl on the day, to $94.87/bbl at 09.00 GMT.

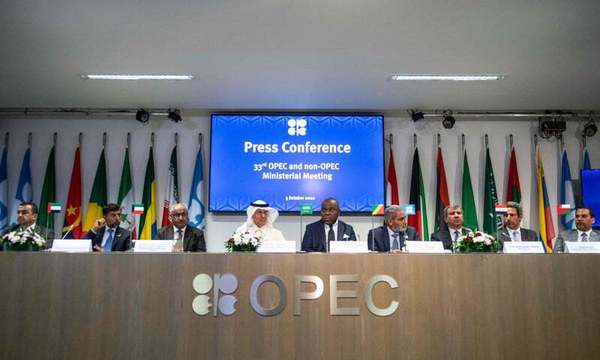

PHOTO: OPEC and allies held a joint press conference at the OPEC Secretariat in Vienna, following the 6th OPEC+ Ministerial Meeting. OPEC

Upward pressure:

Saudi Energy Minister Prince Abdulaziz bin Salman has said the US-led initiative to cap Russian oil prices is adding to uncertainty in the market, and that OPEC and allies (OPEC+) have acted to prevent further instability.

Goldman Sachs has raised its 2022 Brent price forecast up from $99/bbl to $104/bbl, and its 2023 forecast to $110/bbl in a client note, according to multiple reports. It says the OPEC+ output cut is “very bullish” for oil prices.

OPEC+ has agreed to slash its joint production quota by 2 million b/d from August levels starting in November.

Downward pressure:

A looming recession continues to curb crude price gains. A UN agency has warned that a global slowdown could inflict more damage than the 2008 financial crisis and 2020 Covid-19 shock.

Brent plummeted to $9/bbl when nations locked down at the beginning of the pandemic in 2020. The aftermath of the 2008 financial crisis saw weaker demand pull Brent down to $39/bbl.

The International Monetary Fund has cautioned against a slowdown in the world’s biggest economies and oil consumers - the US, China and EU - noting that the “global outlook has darkened by multiple shocks.”

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online