Fuel Switch Snapshot: Bio-bunker premiums grow even bigger

Biofuel premiums over VLSFO and LNG widen

Biofuel bunker demand still sluggish

LNG prices rise on supply concerns

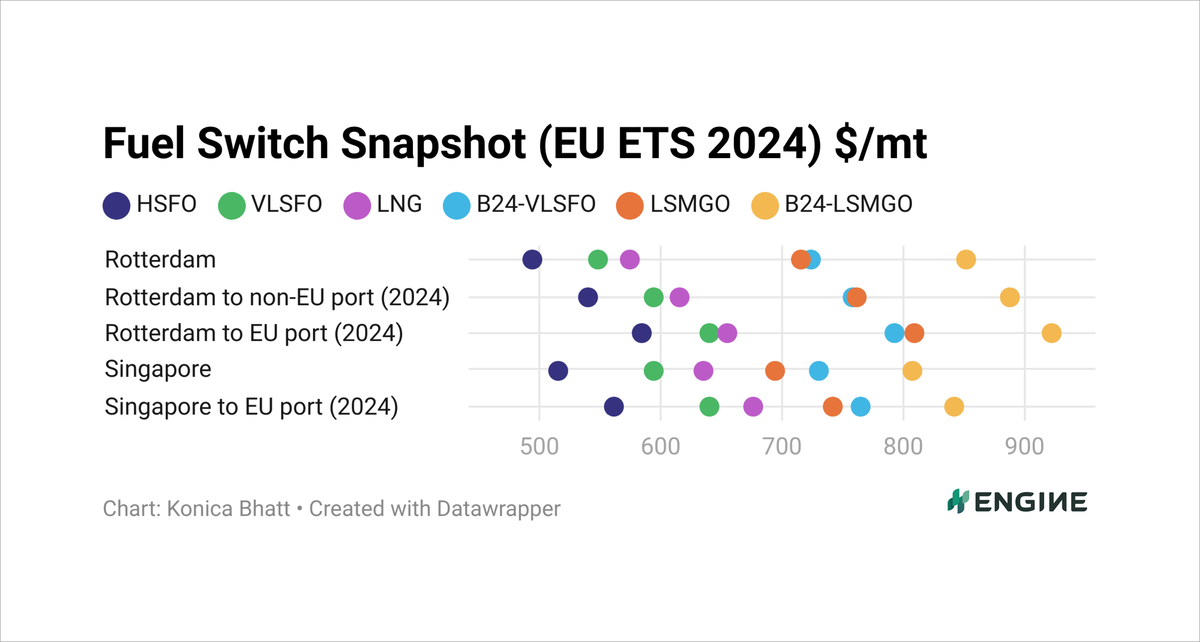

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

Despite rising VLSFO prices over the past week, VLSFO still remains the most affordable bunkering alternative for dual-fuel ships without scrubbers in both Rotterdam and Singapore, even when you factor in estimated EU Allowances (EUAs) costs.

Rotterdam’s B24-VLSFO premium over pure VLSFO has widened by $13/mt in the past week and reached $175/mt. It has also climbed $138-148/mt above the price of fossil LNG in the port.

Rotterdam's LNG, for its part, has gained $5-6/mt on pure VLSFO and moved $15-27/mt above it. Singapore's LNG bunker price premium over VLSFO has increased by just $1-2/mt.

VLSFO

Rotterdam's VLSFO benchmark increased by $12/mt in the past week, which is slightly less than the $22/mt ($3/bbl) bump in front-month ICE Brent futures. When the VLSFO price is adjusted with estimated EUA costs, it has gone up by $7-9/mt.

The price rise has been partially driven by the uptick in Brent futures, but steady availability of the grade in the Rotterdam has limited sharper gains.

Singapore's VLSFO benchmark has been steadier and gained $3-6/mt, which is less than Brent. Improved VLSFO availability in the port has contributed to cap any substantial price hikes there.

Biofuels

Rotterdam’s B24-VLSFO HBE price has spiked by $21-25/mt in the past week, which includes the estimated EUA costs. A steep gain in the price of palm oil mill effluent methyl ester (POMEME) has pushed the benchmark higher. PRIMA-assessed POMEME price in the ARA has gained by $35/mt to $1,393/mt in the past week.

Low voluntary demand and greater bio-premiums have slowed biofuel bunkering demand in Rotterdam and the wider ARA hub, a source says.

Singapore's B24-VLSFO price has remained relatively stable in the past week, rising by only $5-7/mt.

Bio-bunker demand remains sluggish in Singapore. At least two suppliers can offer B24-VLSFO stems with lead times of 10-14 days. Biofuel demand has also been low in Hong Kong.

LNG

Rotterdam's LNG bunker price has gained $13-17/mt amid growing concerns over natural gas supply disruptions in Europe.

Russian gas deliveries to southern and central Europe could be suspended, and increased competition for LNG cargoes with Asia is also adding pressure on LNG supply, Energi Denmark said.

Singapore's LNG bunker price has made a $5-7/mt rise including estimated EUAs costs.

Two liquefaction plants at Chevron's Wheatstone LNG facility in Australia have been shut down for repairs. Wheatstone LNG is one of Australia's largest LNG exporters with a total export capacity of 8.9 million mt/year.

Australia exported around 81.2 million mt of LNG in the year to February, primarily to Japan, China, South Korea and Taiwan, according to data from the Government of Western Australia. As a major supplier, any supply disruption in Australia could potentially impact LNG prices in Asian countries.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online